If you’re in your prime years of working, retirement may seem like a distant event. However, it’s never too early to start planning for your golden years. As the saying goes, “failing to plan is planning to fail.” This rings especially true when it comes to retirement. Thankfully, with the help of professional retirement planning services lansing mi , you can secure your future and enjoy a stress-free retirement.

The Importance of Early Planning

The earlier you start planning for your retirement, the better. By starting early, you’ll have more time to save and invest, giving you a larger cushion to fall back on during your retirement years. With the cost of living constantly rising, it’s important to have a solid financial plan in place so you can maintain your lifestyle even after you’ve retired from work.

Moreover, planning for retirement early also allows you to make smarter decisions when it comes to investments. You have the advantage of time, allowing your investments to grow and multiply. With the guidance of a professional retirement planner, you’ll have a better understanding of where to put your money and how much you should be saving.

Understanding Your Retirement Needs

One of the key components of effective retirement planning is knowing how much you need to save. This can vary depending on your current age, desired retirement age, lifestyle, and income level. A good rule of thumb is to aim for at least 80% of your pre-retirement income to support your lifestyle during retirement.

A retirement planner can help you assess your financial situation and provide recommendations on how much you should save based on your specific needs. They can also help you create a budget and manage your expenses to ensure you stay on track for a comfortable retirement.

Maximizing Retirement Savings

Apart from having a traditional savings account, there are other ways to maximize your retirement savings. For instance, you can contribute to an employer-sponsored retirement plan, such as a 401(k) or a pension plan. These plans often come with tax benefits and employer matching contributions, making them a great vehicle to grow your retirement savings.

You can also explore individual retirement accounts (IRAs) which offer tax-deferred growth for your retirement funds. With IRAs, you have the flexibility to choose from a variety of investment options, including stocks, bonds, and mutual funds. A retirement planner can help you decide which type of IRA is best suited for your financial goals.

Planning for Unexpected Events

Life is unpredictable, and despite our best efforts, unexpected events can occur. This is why it’s important to have a retirement plan that takes into account unforeseen circumstances. You need to have a safety net in place to avoid dipping into your retirement savings prematurely.

Retirement planners can help you create a contingency plan, such as setting up an emergency fund or purchasing insurance policies, to protect your retirement savings from being depleted in case of emergencies.

The Role of Retirement Planners

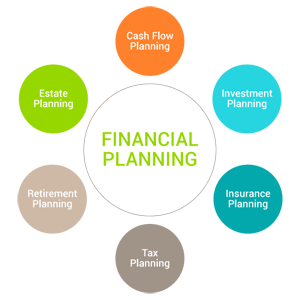

Retirement planning can be overwhelming, especially if you’re just starting out. Fortunately, you don’t have to go through it alone. Retirement planners are trained professionals who specialize in helping individuals plan for their retirement. They have a deep understanding of investments, taxes, estate planning, and other crucial aspects related to retirement.

By working with a retirement planner, you can have peace of mind knowing that you have a solid plan in place to secure your future. They can also help you make adjustments along the way to accommodate any changes in your financial situation and goals.

Start Planning for Your Future Today!

Retirement may seem like a far-off event, but it’s never too early to start planning for it. With the help of professional retirement planning services lansing mi, you can create a roadmap for your golden years and ensure that you can live the life you’ve always dreamed of during retirement. Don’t wait, start planning for a worry-free future today!